Electronic Check Conversion

![]()

CHECK CONVERSION

CHECK CONVERSION

Recent developments in check technology now make it even easier for a business to accept and process check payments. That’s good news for consumers, many of whom favor checks as an easy-to-use payment method. Electronic Check Conversion can be utilized at the point of sale or from the back-office when used to process checks mailed in or presented as payment for a doctor’s visit or invoice payment, for example. Electronic Check Processing provides a fast and easy way to accept checks and speeds up the deposit process by eliminating trips to the bank. Verification and guarantee services may be added to the processing service to help reduce risk and increase revenue.

How It Works-

- The customer writes a paper check

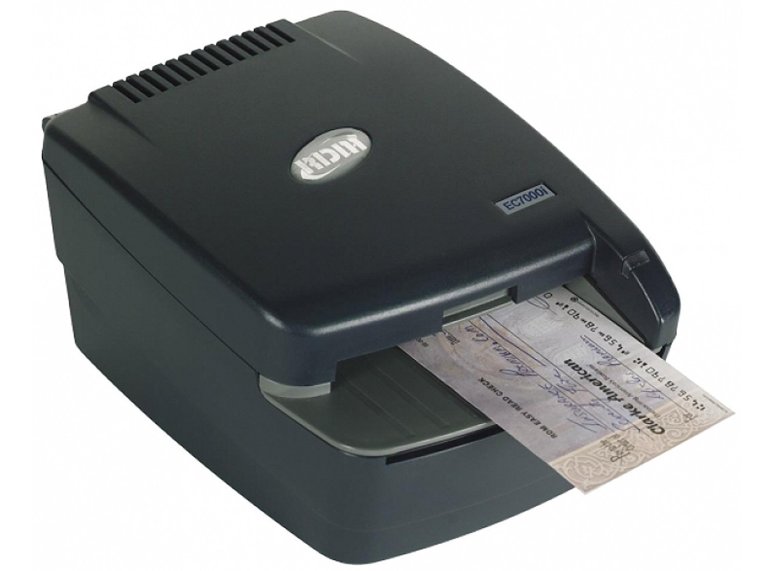

- The check is put through a check reader or imager capturing check information

- The clerk enters in additional information

- The check may be verified or guaranteed (depending on the payment provider)

- A receipt prints for the check writer to sign

- The check is returned or stamped void

- The check information is uploaded to the payment provider for processing and deposit to the merchant’s account usually within 1-2 business days

Auto Dealerships Simplify Check Processing with C.A.R.S

C.A.R.S. offers:

- Wider acceptance of checks, fewer administrative returns*

- Future Deposit program included

- COD premium for Parts and Service

- 24/7 transaction reporting via the Internet

- Eliminates claims submission and claims waiting time

CrossCheck’s Auto Industry RDC Solution (C.A.R.S.) provides your dealership with a fast and easy way to streamline processing and guarantee your check transactions. Innovative features include a Future Deposit function, COD for your Parts and Service department and desktop conversion to eliminate trips to the bank. With each authorized check, funds are automatically processed and deposited into your dealership’s account. Online reporting allows you to easily check status and activity 24/7/365.